The Oil Collapse

The markets have been writing history books the last two months. Ten, twenty, thirty years from now, when I pick up a trading book, or a book on the history of the markets, I will certainly read about March and April of 2020. As a lifelong trader, this is fascinating to me. Watching history be made is amazing.

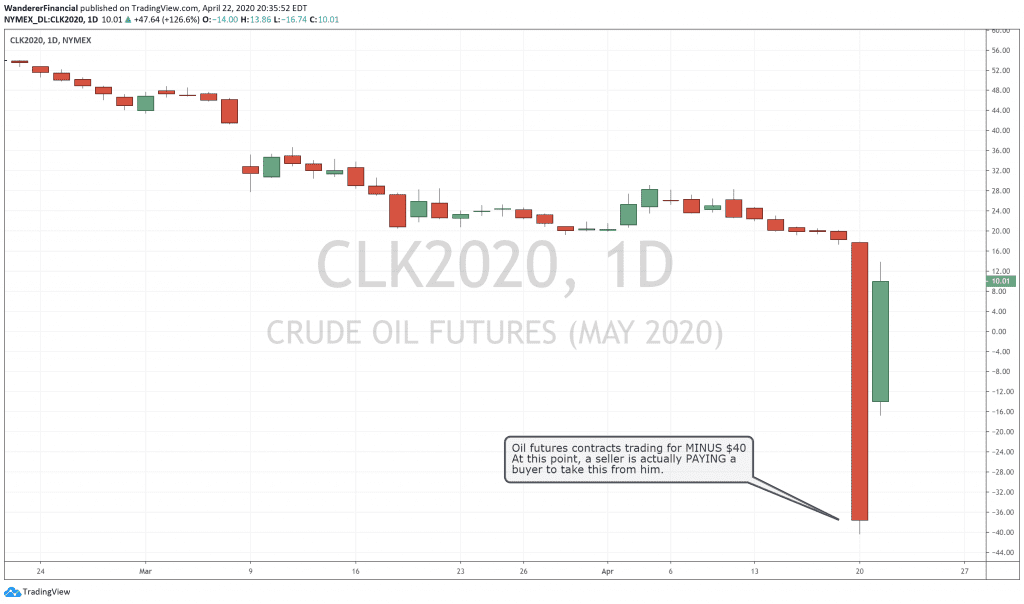

On Monday, April 20th, a new chapter was written. On that day oil crashed to -$40/barrel. Look closely at what I wrote there—that is a MINUS sign in front of the $40. Minus. Forty. Dollars. Per. Barrel.

We don't trade futures at Wanderer Financial, but I started out as a futures trader at the Chicago Board of Trade and to this day I love the futures markets. On days like this I wish that I was back standing in the pits shoulder-to-shoulder with my friends and enemies battling for points. Even sitting at a computer watching the screen I could feel the adrenaline.

What Happened?

So you likely saw the headlines about negative oil, but you might not have known what that really meant. So let me just give you some broad brush strokes, so maybe you can see why it was so exciting for me to watch.

A futures contract is a binding legal contract between a buyer and a seller of a particular commodity or security. The two sides agree to exchange the commodity/security at a predetermined price at a specific date in the future (expiration day).

In this case, oil. The buyer of a May 2020 crude oil futures contract agrees to take delivery of 1,000 barrels of oil, and the seller agrees to deliver them. As recently as April 13th, one week before the May contract's expiration date, oil was trading for $24/barrel. At 1,000 barrels per contract, the buyer was shelling out $24,000 in order to take delivery of that oil one week later, and the seller was collecting $24,000 to sell his 1,000 barrels. Pretty straight forward, right? It's not important to understand exactly how oil is exchanged, just know that if you own that contract on expiration day it is your legally binding duty to take delivery.

Well, here's the rub. The coronavirus has destroyed demand for oil. The world is simply not using oil right now. But oil companies are still pumping it out of the ground just as fast as they can. Like an addict, they can't stop. There are a lot of different reasons for this which we don't need to go into right now, but suffice it to say, we've got a lot more oil coming out of the ground than the world can use right now.

What do they do with all of this excess oil? They store it. You've seen those big white cylindrical storage tanks. Well, those tanks are full. So full that oil is even being stored on ships right now. Ships that charge $100,000/day just to hold it for you.

low world demand + high world supply = world storage shortage

So, what happened? Well, the owners of those futures contracts, the guys who had agreed to buy the oil, didn't have any storage left. None. I can imagine the frantic phone calls that were going out looking for storage that day. Nobody could find any. So what do you do if you have agreed, in a legally binding way, to take delivery of 1,000 barrels of oil and you don't have anywhere to put it? You sell the contract before it expires. You essentiall zero yourself out. In futures trading if you are long one contract, you can simply sell one contract, and now you have zero interest remaining. That's it. Easy.

Well, easy in normal times. But these are not normal times.

This time, when the owners of these May crude oil futures contracts went to sell them, there were no buyers. None. Nobody has space to store oil, so nobody can accept a contract to take delivery of oil. And this is the point where things went crazy on Monday.

The May futures contracts were expiring on Tuesday. So on Monday futures buyers became desperate to sell. So desperate that they would sell at any price. First they sold for $10. Remember they might have bought those contracts for about $24,000 each and now they were worth $10,000. A haircut, but not a knife across the throat.

But buyers were few and far between, and soon they were just gone all together. The price of oil just kept dropping as the owners of those contracts offered to sell them at $10, then $5, then $0. It didn't stop. They'd sell for -$10, -$20, -$40!

Wrap your head around that. The guy that bought a May contract for $24,000 a week earlier now had to pay an additional $40,000 to have someone take it away from him. This is the knife across the thoat.

Put another way, the guy who sold a contract got paid $24,000 a week earlier, and could now collect an additional $40,000 to buy it back.

This was absolutely the craziest thing I've ever seen happen in any market. Hopefully I've explained it well enough that ten years from now, when the cocktail dinner party conversation turns to oil futures trading, you can now say, "Yeah, I remember the negative oil. That was nuts!"

And that is market history being made.