Current Outlook

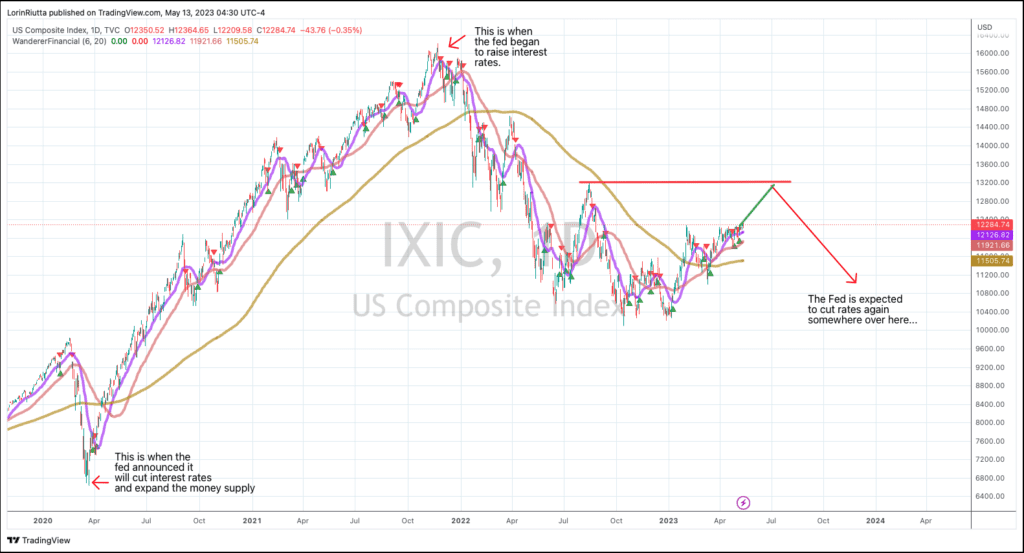

1) Stock Market – Stocks continue the past year's bear market grind.

2) Bonds – The Fed is on pause. It's next move will likely be to lower rates later this year.

3) Currency – The dollar will fluctuate against the Euro and the Yen, but weaken relative to gold.

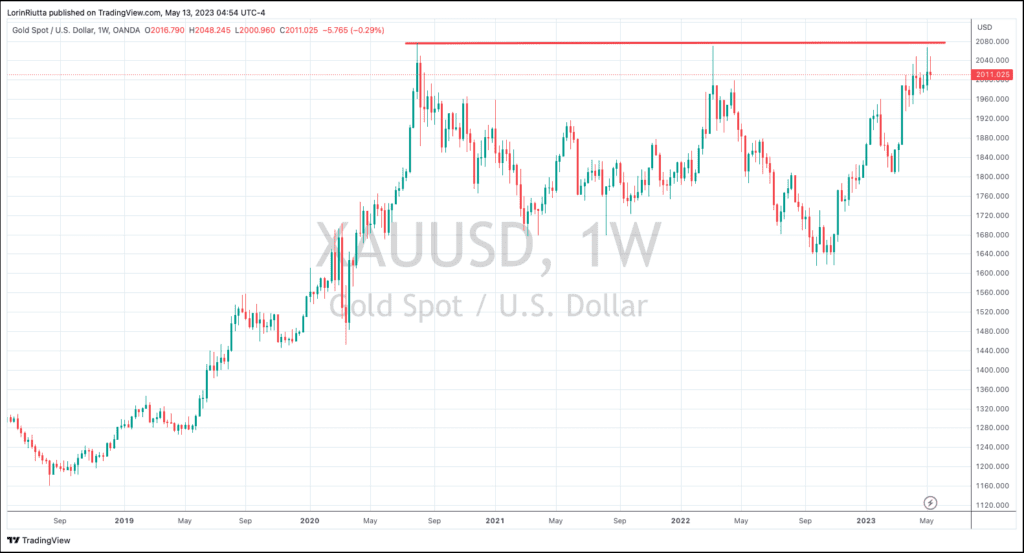

4) Gold – Although the short term risk is high, further upside is expected over the coming days/weeks.

5) Oil – Oil is early in a new cycle where further upside is expected.

Analysis

For the past month, we’ve been spotlighting different nations and examining their age demographics and likely economic trends. When I say that out loud, “fun stuff” doesn’t immediately come to mind, but we’ll do our best to make it interesting.

We’ve been covering how the population is in decline in Japan and Russia, while it is currently peaking in China and Germany. Last week, we looked at the US age demographics, and this week we'll attempt to put it all together in a way that gives us some insight into the future. We aren’t clairvoyant, but if we can light the path forward even a little, it might make the journey an easier one.

From the end of WW2 to when Covid struck marks a special time in all of history. In all human existence, there was never a time like the past 80 years. While it is easy to think of the last 80 years as normal, it was anything but.

When Covid struck, the whole world changed, but it wasn’t just because of Covid. That was merely the straw that broke the camel’s back. Let’s dive in.

The more we research, the more we fear normalcy may return… the real normal where there isn’t just in time delivery and efficient world trade. Where people become more territorial and hostile to free trade. We are starting to see signs of this taking place, and the pace of change is dramatic.

First, let’s look at what was so different about the past 80 years, and why that might change. Following the world wars, the US had no equal in terms of power and wealth. Since the war wasn’t on US soil, we didn’t suffer the destruction that war brings to a region. We lost lives, which is the biggest tragedy, but our home life was mostly spared from the ravages of war.

That left us as an empire that could have taken all kinds of territory for itself. Instead, it allowed nations to remain autonomous, and with the help of the most powerful Navy in the world, it made the oceans safe for transporting things by sea.

Yada yada yada, container ships were created, piracy was largely eliminated, and the waterways were kept open for free trade. Once transport was safe and efficient, specialization took place like never before.

This specialization of labor developed at a dizzying speed. In just a generation, we went from nations being largely self-sufficient and located where natural resources exist to large populations existing in arid deserts where natural food and water are scarce. We went from canning our vegetables to just in time organic leafy vegetables available on demand at the local supermarket. Civilization made centuries worth of progress… in decades.

It’s pretty profound if you think about it. For example, there isn’t any gardening or farming in Manhattan, yet you can get fresh food from around the world on demand there. Trade has become that efficient.

Entire populations remain warm and fed thanks to an intricate system of trade that connects the whole world together so that one region can specialize in producing the world’s wheat, while another focuses on oil.

Reliably being able to import what a nation needs and export what they have surpluses of shrunk the entire world. Ships became bigger, containers became more efficient, and more nations took advantage of something that hadn’t existed before—safe seas.

It got even better. Standards were set for commodities so that a manufacturer in China could order a specific blend of steel from Australia, and craft it into a widget that then gets shipped to the US, where it is purchased for a fraction of what it would cost to manufacture it locally.

The steel can peacefully be shipped to China, and then shipped again to the USA thanks in part to what we alluded to earlier—safe seas enforced by the world’s most powerful navy.

Before the US Navy ruled the waterways, fear of piracy or hostile nations demanding tolls for passage kept business local. There was of course trade, but nothing on the scale of what took place after WW2.

That means things can be made and grown where they are most efficiently made, and shipped to where they aren’t.

All that cooperation between nations had the world running like a Swiss watch. The quality of life was as high as it’s ever been. Stores were stocked full of inventory; Americans didn’t even know what shortages meant. We didn’t have to experience them.

Then, Covid struck. In just months, relationships that took decades to build were severed. Supply lines snapped, and supply chains had links give way. And it couldn’t have come at a worse time.

A chain is only as strong as its weakest link, and the lines connecting China with the US were already under heavy stress. Covid made it MUCH worse. Suddenly, political tensions had a conduit, and in the name of safety, borders between nations suddenly grew trade barriers. Trade became neither fair nor free… In many things, it ground to a halt.

We don’t think it’s coming back. In fact, the conditions present are set to make things worse.

The political tension is heating up between China and the USA. The nations are now growing apart rather than together. That means corporations that utilized China’s efficient manufacturing prowess are in a high-risk area now. Companies like Samsung and Apple are scouting alternative locations for their smartphone assembly.

As companies bring manufacturing home, the cost rises. The reason manufacturing left was because of cost, so to bring it back either means we agree to work for less, or cost-push inflation will persist longer than we think.

With less reliance on trade, we don’t need as heavy of a military presence as we currently have. Without our presence, it could only be a matter of time before regional conflicts make shipping less efficient. It would only take a few acts of piracy for shipping insurance to become untenable.

On top of trade breaking down, we have the retiring baby boomers, rising military conflict, record debt levels, outright deflation of the money supply, and leading indicators that are screaming recession.

In other words, buckle up, it looks to be a bumpy ride.

Stocks

The US government is rapidly running out of cash. There is no way to know exactly what date the government will run out of money. The best estimates range between early June and early August. The exact timing depends on whether the treasury has enough cash to make it to the June 15th quarterly tax payment date.

Between now and when a deal is complete, we expect a lot of talk of default. The majority of market participants know a deal will eventually be completed, but the uncertainty of the timing of the deal could well impact the markets. The increasing frequency of default talk will likely weigh on the markets. Most likely, the impact of no debt deal will encompass a shift away from risk (I.e. stocks) and towards relatively safe holdings.

For short-term funds, the safest holding is probably cash. Treasury securities are also attractive, but only if they mature well after a debt ceiling deal is done.

For those that wish to stick with stocks, a shift away from risk typically involves a move into utilities and consumer staples while cyclical stocks like energy and industrial stocks get sold. We expect a growing demand for put hedges as well, which will push the VIX higher.

Since there is a widespread belief that a political deal will be done to remove the immediate funding problems, at least so far, there has been no urgency to de-risk portfolios. We expect this to rapidly change as the government coffers run dry.

If a deal is reached before the money is gone, expect a deluge of borrowing by the government. This borrowing sucks liquidity out of the system, weighing on stock prices. In other words, whether they reach a deal or not, we aren’t very bullish on the stock market.

A casual glance at the Nasdaq Composite Index would have you believe all is well. But a look beneath the surface shows significant deterioration. For example, even as the Nasdaq reached a 52-week high this week, there were more stocks reaching their 52-week low than 52-week high. A full 60% of the stocks in the Nasdaq are beneath their 50-DMA.

In a nutshell, most likely the current market conditions represent a calm before a storm. The storm is coming, but the exact timing is almost impossible to predict. It partly depends on the government's debt deal, and partly because a recession is rapidly approaching or is already upon us.

Gold

Last week, we said gold was either a screaming buy or a sell, depending on whether you already have some or not. Owning gold is a form of owning financial insurance. We all have some insurance in some form or another. Rarely do we make money on our insurance, but occasionally we are happy that we have it. Since gold performs best when the economy is stressed, it makes sense that anyone who is expecting an economic decline would put at least a portion of their wealth in gold.

Now that we’ve made the fundamental case for owning gold, let’s look at the current technical side of it to see if it represents a good trading opportunity. Looking at a weekly chart, we see gold rose and fell a little before finishing the week very close to where it started. From a trading perspective, the reward-to-risk ratio heavily favors risk. The price is just beneath major resistance and could pull back and consolidate before making it through.

Since the setup remains in play, we will reprint last week's comments about gold.

Barring a complete meltdown of the banking system, we don't think it is quite yet time for gold to break out. There is significant resistance at the $2100 level and it probably will take weeks or months to overcome that resistance. Right now two scenarios are unfolding. On a daily basis, one of two narratives plays out. Either stocks plunge and gold rallies, or the stock market rallies and gold plunges. It all depends on whether the market is in a risk on or risk off mode. Which narrative plays out each day seems to be data-dependent on each specific day. Good earnings? Risk on. News of a bank in trouble? Risk off..... Rinse, repeat.

The Week Ahead

| Tuesday | 8:30 AM | Core Retail Sales (Apr) |

| Tuesday | 8:30 AM | Retail Sales (Apr) |

| Wednesday | 8:30 AM | Building Permits (Apr) |

| Thursday | 8:30 AM | Philadelphia Fed Manufacturing Index |

| Thursday | 10:00 AM | Existing Home Sales |

Wanderer Life

This week I've been watching the markets from Nuku-Hiva in the Marquesas Islands. We're anchored in Taiohae Bay, surrounded by incredible beauty and the mountains that lock us in safe and tight here. One of the only real challenges to trading from around the world is dealing with the changing time zones. Here in Nuku-Hiva they compound the problem by adding in a half-hour time zone. So, while the stock market opens at 9:30, here we ring the trading bell at 4:00 am. Sure, it's early, but when you have the whole afternoon to swim and explore, going to bed a little earlier is but a minor inconvenience.

~Pat