The Real Trump/China Risk

A "theme" of our investing at Wanderer since the beginning of 2025 has been that Chinese stocks are undervalued relative to their American peers. This has been a strong performer, with the FXI China Large-Cap ETF outperforming the S&P ~31% to ~18% since then (see chart below with S&P in blue).

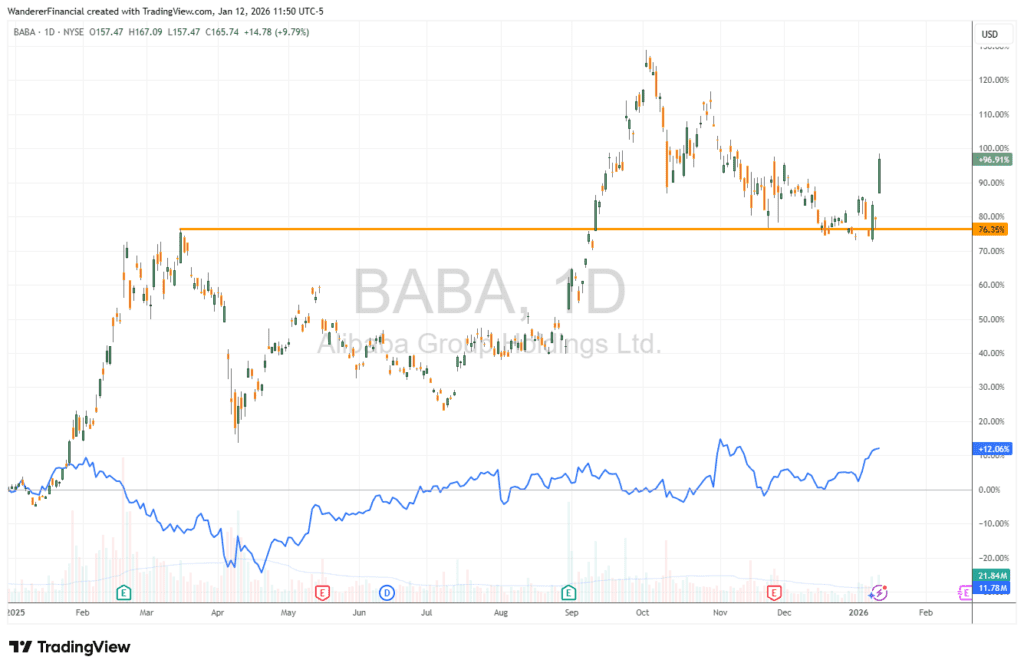

The outperformance has been especially striking in one of our favorite trade targets BABA, which is often referred to as the Amazon of China (AMZN in blue on the chart below) with an outperformance of ~97% to ~12%.

Most Americans who want a piece of China’s growth do so through American Depositary Receipts, or ADRs. These are essentially certificates that trade on U.S. exchanges like the New York Stock Exchange or Nasdaq. When you buy an ADR of a company like Alibaba (BABA), you aren't actually buying the shares in China directly. Instead, a U.S. bank holds the foreign shares for you and issues the ADR so you can trade it in U.S. dollars during normal market hours. It’s a convenient bridge, but that bridge can be closed by the government at any time.

In our minds the big risk right now is that the Trump administration could use an executive order to deem certain Chinese companies a national security threat. This is a powerful tool that the President can use to effectively "blackball" a company from the U.S. financial system. If a company like Alibaba is labeled a threat because of its work in AI or cloud computing, the order could ban any U.S. person or institution from owning its stock. We have seen versions of this before. When Russia invaded Ukraine many Americans woke up to find their Russian ADRs (mainly oil related companies) had become worthless. A stock that was $15 the night before was effectively worth $0 the next morning. While Russia was primarily a commodity crackdown, China would be a much wider ranging tech/AI crackdown. We believe that the threat of a wider ban is a real part of the 2026 political landscape.

If an executive order like this were signed, the immediate aftermath would likely be chaotic. Major U.S. exchanges would be forced to delist the stock, and large institutional investors would have to dump their shares regardless of the price. You would likely see a massive gap down in the stock price as liquidity vanishes. The ADR would move from the NYSE and Nasdaq to the "Pink Sheets" or Over-the-Counter (OTC) markets, where trading is thin, spreads are wide, and finding a buyer becomes a major headache. Many brokerages don't even allow their retail traders to trade in the OTC market.

Many investors think they can just wait for the dust to settle, but in this scenario, there is no easy "out" for Americans. Once the ban is fully active, U.S. brokers are often prohibited from even transferring the shares to a different account. You might have the right to convert your ADRs into local Hong Kong shares, but you might not have the ability to do so. In addition, that process takes time and costs money. More importantly, if the ban covers the underlying company, you are still legally barred from owning those Hong Kong shares, too. You could find yourself stuck with a zombie asset that you literally cannot sell to anyone in the United States.

ETFs provide a small buffer against this risk because they are professionally managed. If a specific company in a China ETF gets banned, the fund manager is the one who has to handle the messy work of selling the shares or converting them to a different currency. Because many of these ETFs already hold "H-shares" listed in Hong Kong rather than U.S. ADRs, they aren't quite as vulnerable to a simple exchange delisting. It doesn't eliminate the risk entirely, but it prevents you from being the one stuck on the phone with a broker trying to figure out how to trade a delisted stock. Even this professional manager is almost certainly going to take a significant hit on the liquidation of these shares.

We want to be clear that this isn't a high-probability event, but it certainly isn't a zero-probability event either. In the current world of shifting trade alliances and national security concerns, it’s a tail risk that every Wanderer investor needs to be aware of. It’s about weighing that potential volatility against the rest of your portfolio. Part of being a smart navigator is knowing where the rocks are, even if you don't expect the tide to go out that far today.

Keep Up With the Wanderer Crew No Matter Where We Are

Living, trading, and running a business from a boat is pretty amazing. Just ten years ago the idea of doing all of this would have seemed impossible. While technically it may have been doable, it would have been a near constant headache, mostly due to internet connectivity. These days, almost nothing stands in the way of a mobile lifestyle, whether retired or working or some mixture of both.

Ready to Learn & Explore More?

If you haven't done so already, it's a great time to subscribe. Whatever your dreams for a Wandering life include, the shortest path to finding them starts right here. You don't have to do it the hard way by learning on your own and making costly mistakes. The financial education and professional trading strategies alone are worth the cost of an annual subscription. But when you add in the guidance and advice shared by hundreds of experienced Wanderers who are already living a SELF-dependent, pretired life–now that is truly priceless.

The world is waiting. Join us and hundreds of successful Wanderers and subscribe today.