Time—A Kid's Best Friend

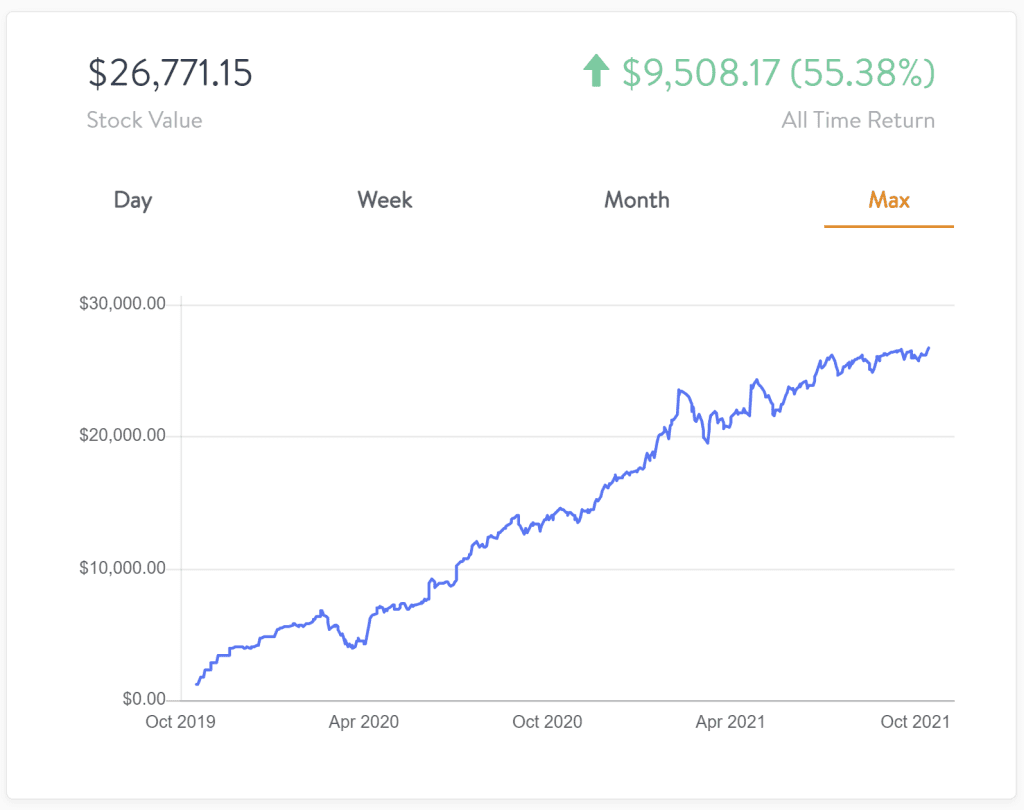

It has already been two years since I started this series on Kids Investing. In 2019 we made a $5,000 deposit into each of my kids' new Stockpile accounts, and off we went. They've already weathered their first bear market, with COVID coming along to shave about 40% off of their accounts for a few months, but honestly, bear markets are nothing but an opportunity for young, long-term investors.

We made their 2020 deposits around the time COVID hit and they were able to take advantage of the low stock prices to grab a number of companies incredibly cheap. Since then we've also added their 2021 deposits.

Along the way, they've learned a lot, and even went so far as to deposit some of their own money from birthdays and allowances into the accounts. Ultimately, this is the real goal, right? Teach your children how to invest so that when the time comes, and they have a choice between spending a hundred dollars, and investing it, they choose to bypass the less satisfying immediate return of a new gadget for the potentially more satisfying long-term return of stocks. If we can give children, who quickly become young adults, that moment of hesitation early on, they will at least have the potential of making the right decision for themselves. Without having this investing knowledge, they are left with little option of what to do when they come across a hundred dollars.

Fractional Ownership

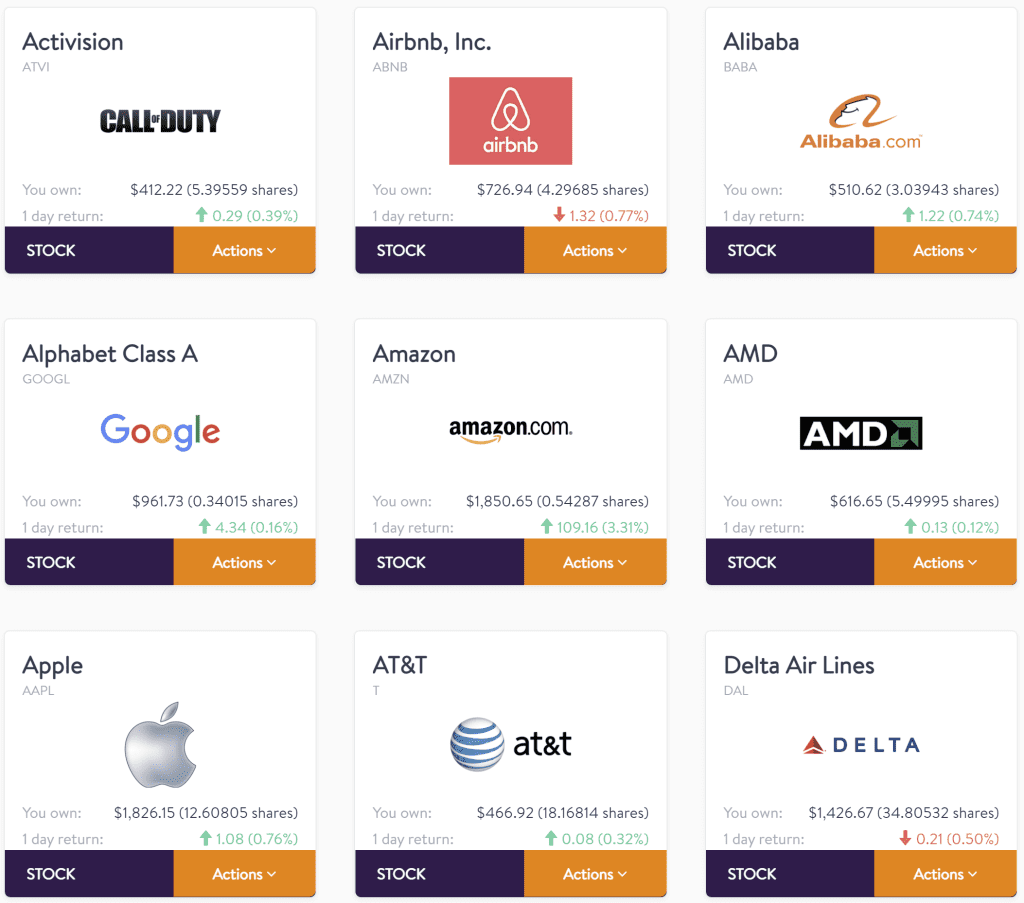

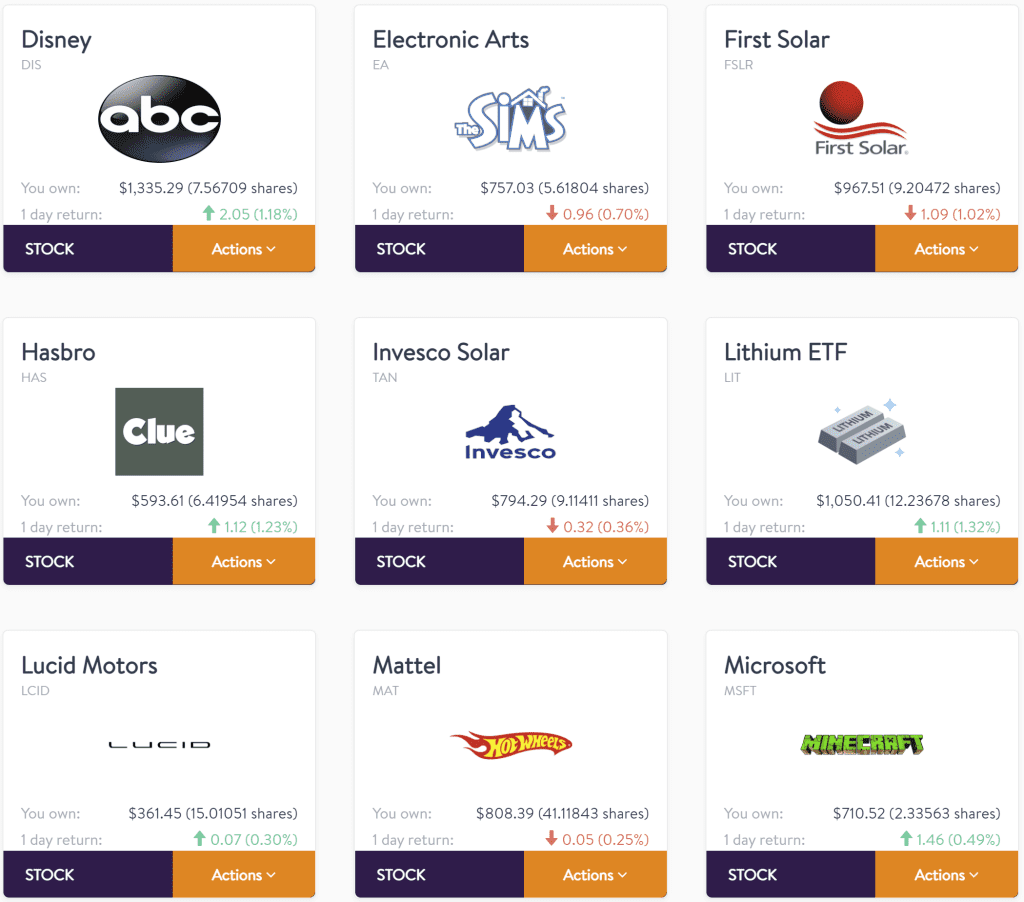

One of the truly transformational changes that has occurred in investing these past few years is fractional share purchases. Without the ability to buy partial shares of things like Amazon (current stock price $3,400), it is highly unlikely that they would own any of the stock. Instead, they were able to buy just over half of a share and watch its price double.

You can see in the list of positions below that they also own just a fraction of a share of Google. But, in addition to owning a fraction of less than one share, this also makes life easier as far as distributing funds. We are able to easily buy a nice round dollar amount of a stock, or spend every last cent of cash that's in the account. There is no hunting around for shares that cost a certain amount, in order to buy something.

It's also worth pointing out that many of these stocks pay a dividend. The cash from these is automatically used to purchase more stock. A recent example was a dividend from Target for $4.69. Without any effort on our part, the money was used to buy .01896 shares of Target stock. It's not much, but again, over time it adds up.

Some of the Lessons Learned

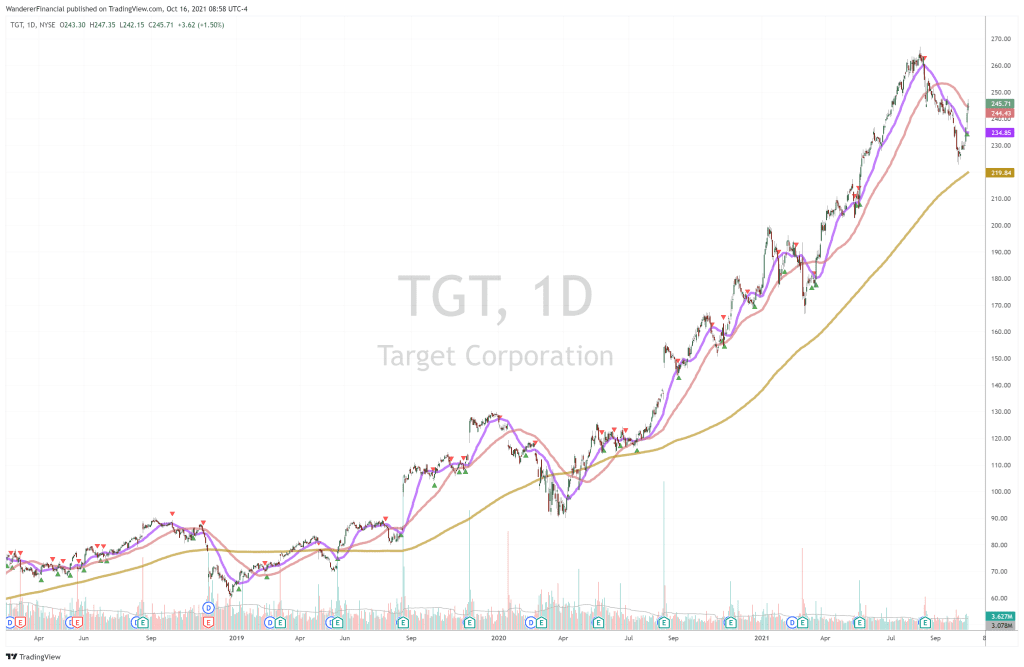

One of the stocks the kids bought on their first day was Target. I've discussed previously how investing in companies that kids know, and like, is a key to keeping them involved and interested in investing. What kid doesn't love a trip to Target's toy aisles? This seemingly unexciting, non-techy retail pick has returned over 100% in their first two years of ownership. Not bad at all.

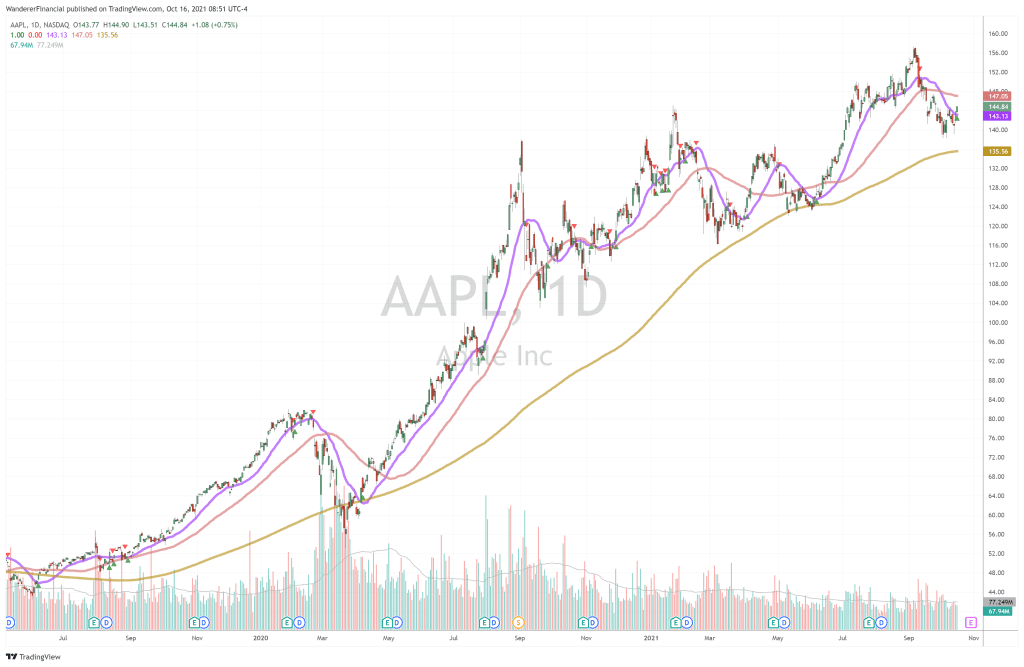

Remember when Apple was just a fledgling little business with a market cap of under $1 Trillion? I joke, but someday my kids will message their friends over their iHologramPhone and tell them about one of their first stock purchases—AAPL for $60/share. Not exactly IPO level, but a heck of an investment so far. It sometimes might feel like a stock has run its course, but because of our long-term time horizon, it may actually have a long steady climb still ahead of it.

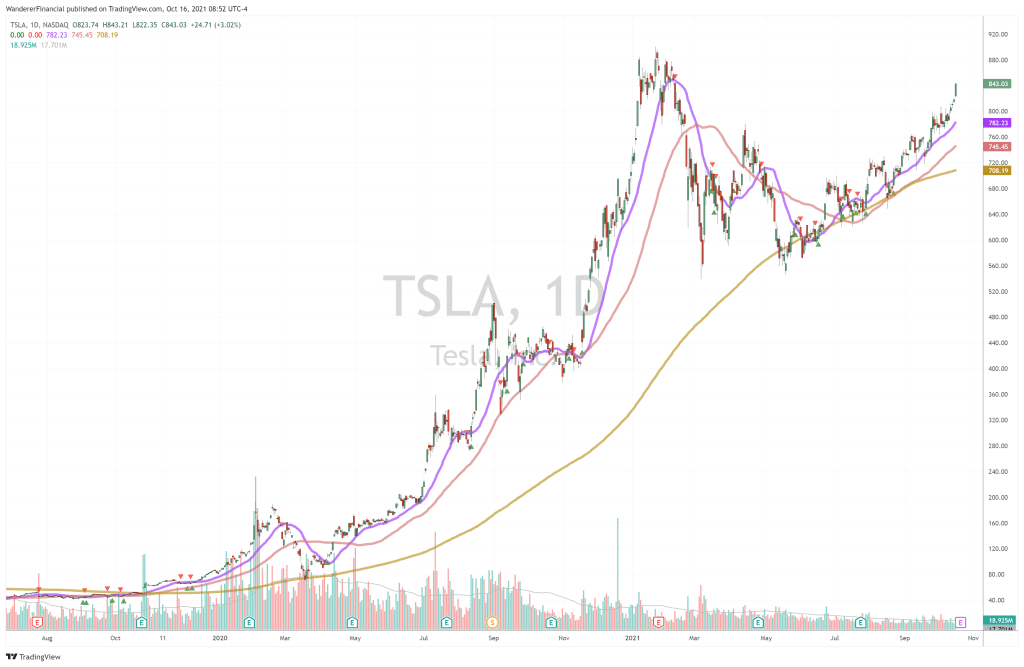

I talk about a kid's ability to make risky trades. In April of 2020 Tesla's stock had been cut in half from the February highs, and many wondered if the stock would ever see those highs again. Fortunately, though, we had waited to make their 2020 account deposit until the end of March, right as the COVID lows had ultimately been made. With risky money to put to work they took their Tesla shot and bought in at $103/share. With the stock standing at $843 now, this one appears poised to pay for their own car some day.

This is also a good example of a stock that is easy to talk about with kids. I'm very into vintage cars and RVs, and in my kids' entire lives I've never owned a vehicle that isn't at least 50 years old. But when talking to young kids about cars these days it's impossible not to come to the realization that there is a very good chance that they will never own an internal combustion engine car. Unless they are into vintage vehicles, too, the obvious choice five or ten years from now appears to be an EV. Time will tell. In the meantime, it's an interesting talking point, and one that kids can certainly understand and get interested in.

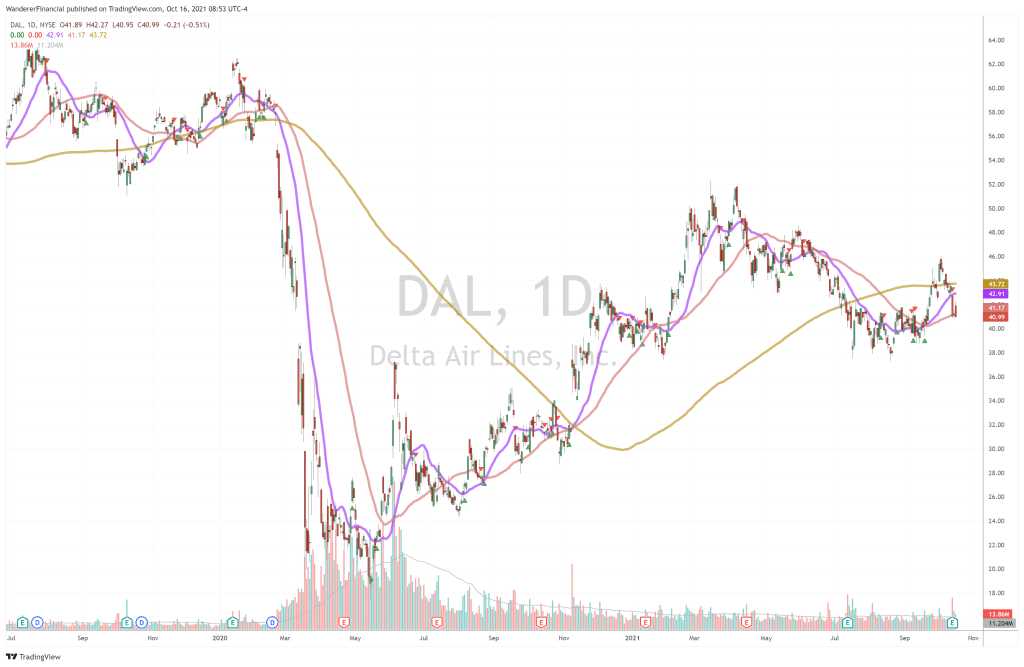

Delta is another fluke of good COVID timing. The pandemic opened up a wide avenue of interesting topics to discuss with kids about investing. One of those was a sort of, "Is the world really ending?" For those who were depending on their pre-COVID investments to carry them through retirement, it could certainly feel that way. But for kids, the investing question really became about what did they think would happen once the virus was gone. Would people still fly on vacation, or to visit family, or to go on a business trip? Or would everyone switch to driving across the country? The answer seems obvious in retrospect, while at the time, the answer could really hinge on where you sat on the investment timeline. My kids saw this as an investing opportunity, and bought Delta for $22/share right at the bottom. Eighteen months later that line of thinking has netted them about a one hundred percent return.

Delta was another discussion where kids could really have an opinion. For a traveling family like us, choice of favorite airline is an actual topic of discussion that comes up regularly. Did they want to buy AAL? No, they hate American's uncomfortable seats and lack of built-in entertainment. What about Southwest? No, we never get to sit together. Our family favorite is a clear cut call for Delta.

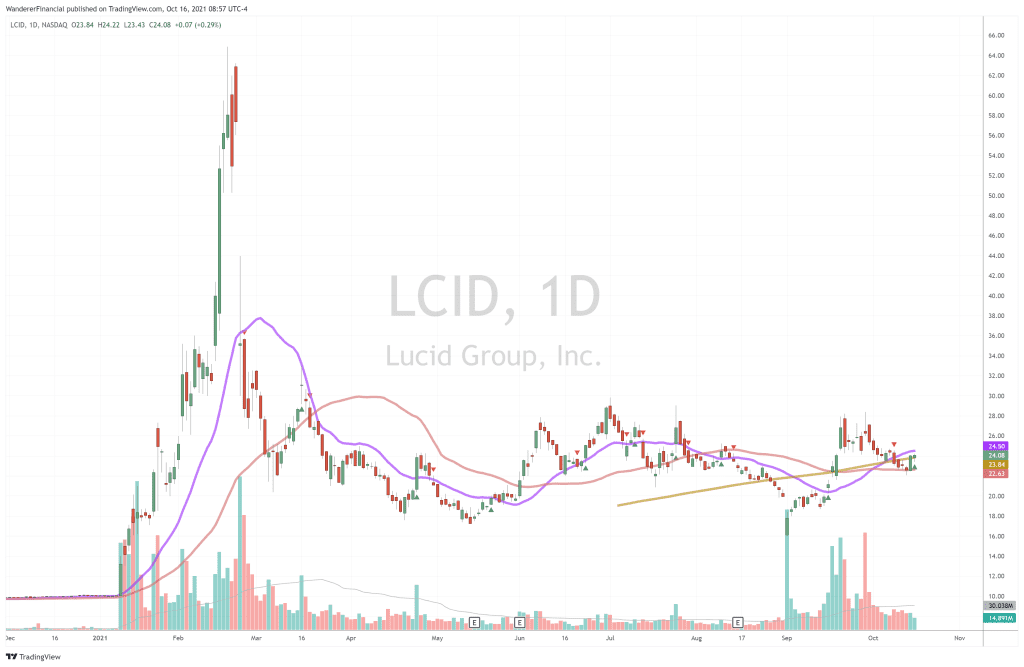

As stated before, one of the best things about investing young is the ability to make a few riskier investments. Things that might have potential to go "to the moon" but could just as likely end up in the bankruptcy column. I was going to point out Lucid as a good example of this (a risky stock that doesn't pan out), as their initial purchase of the electric vehicle stock at $33, quickly shot up 100% in a couple of days, only to tumble to their 2-year anniversary date level of $24, down about 30% and not sounding very promising. Of course, a few days later as I was writing this article, the company announced the delivery date of their first cars off the production line and the stock soared right back up to $37. Who knows where it will end, but for a ten-year-old with nothing but time, letting a start-up car company make a run at becoming a success is a risk that can certainly be tolerated.

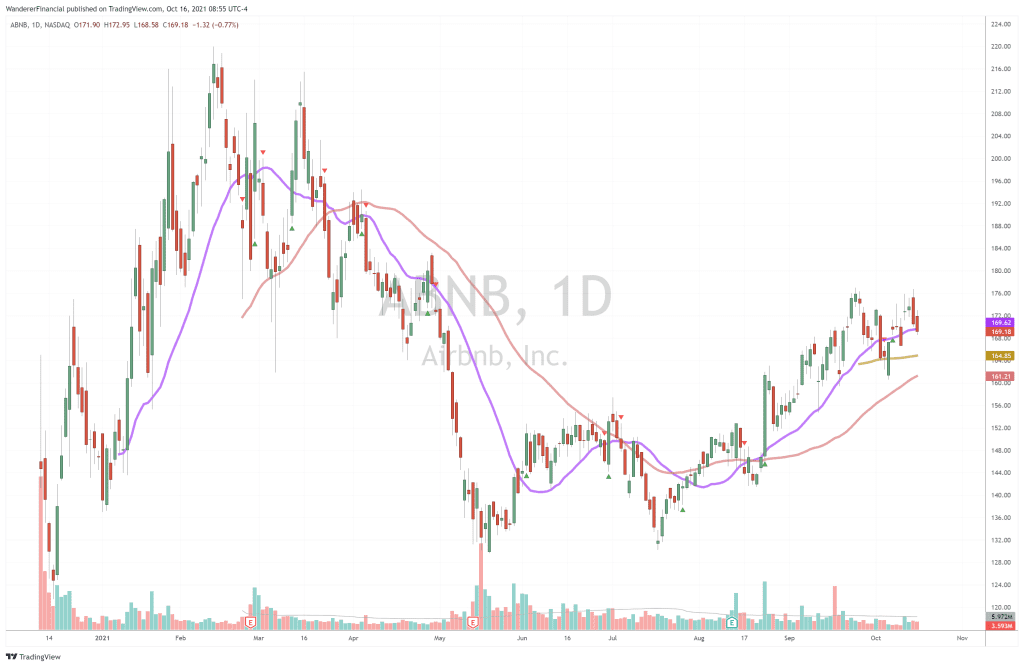

Not all trades are big winners right off the bat. Traveling all over the world we, like so many others, have become steady users of Airbnb. It was sort of a no-brainer that when we were discussing potential trades at the beginning of 2021, ABNB would be part of that. They purchased it at $200, just four days before the high was put in. Whoops. But hey, short-term doesn't matter when you are ten years old. And sometimes those short-term drops can present nice long-term opportunities. When they had some more money to put to work in July, with ABNB sitting down at $139, they took the opportunity to add more. ABNB makes headlines now and then, and when they do, those headlines can open up good opportunities for discussion as well. Fair housing, whether our needs as travelers infringe on the needs of neighborhoods, and whether or not we would even be able to visit certain places if not for the availability of a home for rent where no hotels exist.

Conclusion

It's obviously been a wildly successful two years for the Kids Investing portfolios. Financially they have greatly outperformed any other investment vehicle, other than maybe cryptocurrencies. That's a topic for another day, though. A great, wide-ranging, portfolio base has been built over this time. It is one which has them well positioned for the future, with a mix of stocks in hot, high-flying industries, and others that are simple well-established brands sure to be around for many years to come. Two years in now, they'll also get to begin seeing the biggest advantage to starting young—Compounding Growth. Those numbers are really going to begin to pop.

In addition to the money, though, are all the simple financial lessons learned along the way. Kids soak up everything, yet too often they aren't included in discussions about money. Having their own portfolios makes it easy to have these discussions. We're not opening the family vault for them to see everything (though for many families this may not be a bad thing to do), but instead we get to discuss their own financial future. Some will think that "giving" kids money is a recipe for disaster. They'll turn eighteen, buy a fast car, a case of beer, and head to Vegas with their friends. But I like to believe instead, that helping them build this foundation, and teaching them lessons along the way will make them smart money managers all on their own, when the time comes. They'll understand what constitutes a good use of money (what's truly an asset, and what is just a short-term liability), what happens if they sell their stock in order to buy something else (taxes, and loss of that investment income), and will have the opportunity to make life choices that are different than simply, "I have to take this job to pay my rent."

Only time will tell how financially savvy kids will be, but while we wait to find out, we can use that time to build wealth.

Keep Up With the Wanderer Crew No Matter Where We Are

We live an unconventional life. My kids have spent all of theirs either on the water, or on the road. Because of Covid restrictions, we recently left our boat behind in Aruba for the time being, and headed to the States to join the many others who have decided to spend this time traveling by RV. We picked up a vintage 1965 Bluebird Wanderlodge off of Craigslist, picked it up, and drove south until we hit ocean again.

Our lifestyle provides us with endless possibilities. Possibilities which are available to us because of technology. Because I'm a trader and investor, I'm able to simply log on from anywhere in the world and conduct my business. While I don't in any way push my kids to do the same thing I do, I enjoy at least giving them some of my knowledge so that whatever they end up doing someday, they are able to enjoy the same life of freedom that I have.

Ready to Learn & Explore More?

If you haven't done so already, it's a great time to subscribe. Whatever your dreams for a Wandering life include, the shortest path to finding them starts right here. You don't have to do it the hard way by learning on your own and making costly mistakes. The financial education and professional trading strategies alone are worth the cost of an annual subscription. But when you add in the guidance and advice shared by hundreds of experienced Wanderers who are already living a SELF-dependent, pretired life–now that is truly priceless.

The world is waiting. Join us and hundreds of successful Wanderers and subscribe today.